A list of goods exempted from sales tax is a consumption tax levied by the government on the sale of goods. A traditional good exempted from sales tax is levied at the place of sale, collected by the retailer, and paid to the government.

A business is liable for sales taxes in a given jurisdiction if it has a nexus there, which may be a brick-and-mortar location, an employee, an affiliate, or some other presence, depending on the laws in that jurisdiction.

Traditional or retail sales taxes are charged only to the end-user of a good or service. Since most goods in modern economies go through several stages of manufacture, often handled by different entities, a significant amount of documentation is needed to prove who is ultimately liable for sales tax.

For example, suppose a sheep farmer sells wool to a yarn maker. To avoid paying goods exempted from sales tax, the yarn manufacturer has to obtain a resale certificate from the government stating that it is not an end-user.

The yarn manufacturer then sells its product to an apparel manufacturer, who must also obtain a resale certificate. Finally, the apparel manufacturer sells the fuzzy socks to a retail store, which will charge the customer sales tax along with the cost of the said socks.

List of goods exempted from sales tax

Under various taxation systems, many goods are exempted from sales tax for socio-economic reasons. For example, under the service tax regime, clinical and education services were exempt from service tax. Similarly, the sales of life-saving drugs or reading books were exempted from taxes in various state governments.

Like all such taxes, there are some exceptions under GST where goods or services are goods exempted from sales tax liability. Such exemption on specified goods or services is given by the government based on certain conditions.

Therefore, while determining the tax liability under GST, there is a need to examine not only those goods or services which are chargeable to GST. But, one also needs to look into those goods or services which are exempt from tax. (Private Limited companies in Pakistan)

- Live animal

- Meat

- Fish, meat, and fillets

- Eggs, honey, and milk products

- Inedible animal products

- Living trees and plants

- Fruits and dried fruits

- Tea, Coffee, and Spices

- Foodgrains

- Milling industry products

- Oilseeds, fruits, and parts of plants

So let’s start to learn it in detail…

Live animal goods exempted from sales tax

• Live donkeys, mules, and hinnies (HSN code – 0101)

• Bovine Animals (Live) (HSN Code – 0102)

• Live Swine (HSN Code – 0103)

• Sheep and Goats (Live) (HSN Code – 0104)

• Birds of live poultry, namely Gallus domesticus, ducks, geese, turkeys, and guinea fowl (HSN code – 0105)

• Other living animals such as mammals, birds, insects (HSN code – 0106)

Meat goods exempted from sales tax

• Meat of bovine animals, fresh and chilled (HSN code – 0201)

• Meat or frozen meat of bovine animals (other than frozen and put up in unit container) (HSN Code – 0202)

• Pork, fresh, chilled or frozen (other than frozen and placed in the unit container) (HSN code – 0203)

• Meat of sheep or goat, fresh meat, chilled meat or frozen meat (other than frozen and put up in unit container) (HSN code – 0204)

• Meat of horses, donkeys, mules or hinnies, fresh, chilled or frozen (other than frozen and put up in unit container) (HSN Code – 0205)

• Food refraction of bovine animals, swine, sheep, goats, horses, donkeys, mules or herons, fresh, chilled or frozen (other than frozen and kept in the unit container) (HSN Code – 0206)

• Poultry and edible offal, fresh, chilled or frozen (other than frozen and put up in unit container) of top 0105 (HSN code – 0207)

• Other meat and edible meat offal, fresh, chilled, or frozen (other than frozen and put up in unit container) (HSN code – 0208)

• Pig fat, free of lean meat, and poultry fat, not provided or otherwise removed, fresh, chilled or frozen (other than frozen and kept in a unit container) (HSN code – 0209)

• Poultry fat, free from lean meat, and pork fat, not provided or otherwise extracted, salted, salted, dried or smoked (other than put up in unit containers) (HSN code – 0209)

• Meat and edible meat offal, in salted, salted, dried, or smoked; Edible flour and meat or meat meal, other than put up in unit containers (HSN code – 0210)

Fish, meat, and fillets

• Whether fish seeds, prawn/prawn seeds in a processed, treated, or frozen state (other than goods covered under Chapter 3 and 5% attractant) (HSN Code – 3)

• Fish, fresh or chilled, except fish fillets and other fish meats of heading 0304 (HSN code – 0302)

• Live Fish (HSN Code – 0301)

• Fish fillet and other fish meat (whether minced or not), fresh or chilled (HSN code – 0304)

• Crustaceans, in a shell or not, live, fresh or cold; Crustaceans, in shell, cooked by steam or by boiling in water, fresh or cold (HSN code – 0306)

• Mollusks, whether in the shell or not, live, fresh, chilled; aquatic invertebrates other than crustaceans and mollusks, live, fresh or chilled (HSN code – 0307)

• Aquatic invertebrates other than crustaceans and mollusks, live, fresh, or chilled (0308)

Eggs, honey, and milk products

Natural honey, other than put up in a unit container and bearing a registered brand name (HSN code – 0409) goods exempted from sales tax.

Fresh milk and pasteurized milk, including separated milk, milk, and cream, neither concentrated nor with added sugar or other sweeteners, except Ultra High Temperature (UHT) milk (HSN code – 0401).

Curd; Lassi; Buttermilk (HSN Code – 0403)

Chhena or Paneer, other than put up in unit containers and bearing a registered brand name (HSN Code – 0406) Bird eggs, in shell, fresh, preserved, or cooked (HSN code – 0407)

Inedible animal products goods exempted from sales tax

• human hair, unwashed, whether or not washed; Waste of Human Hair (HSN Code – 0501)

• All goods i.e. bones and horn-cores, unworked, deformed, simply prepared (but not cut to size), treated with acid or gelatin; Powder and Waste of These Products (HSN Code – 0506)

• Semen including frozen semen (HSN code – 0511)

• All goods i.e. hoof food; horn meal; hooves, claws, nails, and beak; Horn; etc. (HSN Code – 050790)

Living trees and plants

• live trees and other plants; bulbs, roots, and so on; Cut flowers and ornamental leaves (HSN Code – 6)

• vegetables

• Tomatoes, fresh or chilled (HSN code – 0702)

• Cucumbers and cucumbers, fresh or chilled (HSN code – 0707)

• Fresh or Chilled Potatoes (HSN Code – 0701)

• Onions, shallots, garlic, leeks, and other vegetables, fresh or chilled (HSN code – 0703)

• Cabbage, cauliflower, kohlrabi, kale, and similar edible brassicas, fresh or chilled (HSN code – 0704)

• Lettuce (Lactuca sativa) and chicory (Cichorium spp.), fresh or chilled (HSN code – 0705)

• Carrots, turnips, lettuce beets, salsify, oregano, radishes, and similar edible roots, fresh or chilled (HSN code – 0706)

• Other vegetables, fresh or chilled (HSN code – 0709)

• Dried vegetables, whole, chopped, chopped, broken, or powdered, but not further prepared (HSN code – 0712)

• Manioc, arrowroot, turnip, Jerusalem artichokes, sweet potatoes, and similar roots and tubers with high starch or inulin content, frozen or dried, whether sliced or in the form of pellets (inserted from 14/11/2017: and put into) unit container and –

• having a registered brand name; Or

• displaying a brand name on which an actionable claim or enforceable right is available in court [other than those where any actionable claim or enforceable right in respect of such brand name has been voluntarily renounced ] (HSN Code – 0714)

• Dried legumes, peeled, whether peeled or split (HSN code – 0713)

• Manioc, arrowroot, cells, Jerusalem, artichokes, sweet potatoes, and similar roots and tubers with high starch or inulin content, fresh or chilled; Sabudana Peeth (HSN Code – 0714)

Fruits and dried fruits

• Coconut, fresh or dried, whether peeled or peeled (HSN code – 0801)

• Brazil nuts, fresh, whether peeled or peeled (HSN code – 0801)

• Other nuts, other nuts, fresh such as almonds, hazelnuts or filberts (Corylus spp.), walnuts, chestnuts (Castanea spp.), pistachios, macadamia nuts, kola nuts (Cola spp.), areca nuts, fresh, whether or not peeled or peel (HSN code – 0802)

• Bananas, including fresh or dried (HSN code – 0803)

• Dates, Figs, Pineapple, Avocado, Guava, Mango and Mangosteen, Fresh (HSN Code – 0804)

• Citrus fruits, such as Oranges, Mandarins (including tangerines and satsuma); Clementine, Wilking and similar citrus hybrids, including grapefruit, pomelos, lemon (Citrus Limon, Citrus Limonum) and lemon (Citrus aurantifolia, Citrus latifolia), fresh (HSN code – 0805)

• Grapes, Fresh (HSN Code – 0806)

• Melons (including melons) and papayas (papayas), fresh (HSN code – 0807)

• Apples, pears, and quinces, fresh (HSN code – 0808)

• Apricots, cherries, peaches (including nectarines), plums and slaw, fresh (HSN code – 0809)

• Other fruits such as strawberries, raspberries, blackberries, mulberries and loganberries, black, white or red currants and gooseberries, cranberries, bilberries and other fruits of the genus Vaccinium, kiwi fruit, durian, persimmon, pomegranate, tamarind, sapota (chico), custard- Apple (Atta), Bor, Lychee, Fresh (HSN Code – 0810) goods exempted from sales tax

• Citrus fruit or melon rind (including melon), fresh (HSN code – 0814)

Tea, Coffee, and Spices

• Coffee beans, not roasted (HSN code – 0901)

• Unprocessed Green Tea Leaves (HSN Code – 0902)

• fennel, fennel, fennel, coriander, cumin or cumin seeds; Juniper berries [of seed quality] (HSN code – 0909)

• Fresh turmeric, other than in the processed form (HSN code – 09103010)

• Ginger (fresh), other than in processed form (HSN code – 09101110)

• All Goods of Seed Quality (HSN Code – 09) goods exempted from sales tax

Foodgrains goods exempted from sales tax

• Wheat and Meslin (other than put up in a unit container and with a registered brand name) (HSN Code – 1001)

• Rye (other than Rye put up in a unit container and bearing a registered brand name) (HSN Code – 1002)

• Barley (other than barely put up in the unit container and bearing a registered brand name) (HSN Code – 1003)

• Oats (except those put up in the unit container and bearing a registered brand name) (HSN Code – 1004)

• Maize (corn) (other than put up in the unit container and bearing a registered brand name) (HSN Code – 1005)

• Rice (other than rice put up in the unit container and bearing a registered brand name) (HSN Code – 1006)

• Grain Jowar (other than put up in a unit container and bearing a registered brand name) (HSN Code – 1007)

• buckwheat, millet, and canary seeds; Other cereals like jowar, bajra, ragi (other than put up in a unit container and with registered brand name) (HSN code – 1008)

Milling industry products

• Wheat or meslin flour (other than put up in a unit container and bearing a registered brand name) (HSN Code – 1101)

• Cereal flour other than wheat or meslin, maize (corn) flour, rye flour, etc. (Other than put up in a unit container and with a registered brand name) (HSN Code – 1102)

• Guar Meal (HSN Code – 11061010)

• Cereal grains, meal, and pellets (other than put up in a unit container and bearing a registered brand name) (HSN Code – 1103)

• Potato flour (except those put up in the unit container and the whose registered brand name has been removed with effect from 10/11/2017) (HSN Code – 1105

• Whole Grains (HSN Code – 1104)

• Flour, of dried leguminous vegetables of heading 0713 (Pulses) (other than Guar Meal 1106 10 10 and Guar Gum Refined Split 1106 10 90), of sago or roots or tubers of heading 0714 or products of Chapter 8 i.e. Tamarind, Singoda Mango Flour, etc. (other than put up in the unit container and bearing a registered brand name) (HSN Code – 1106)

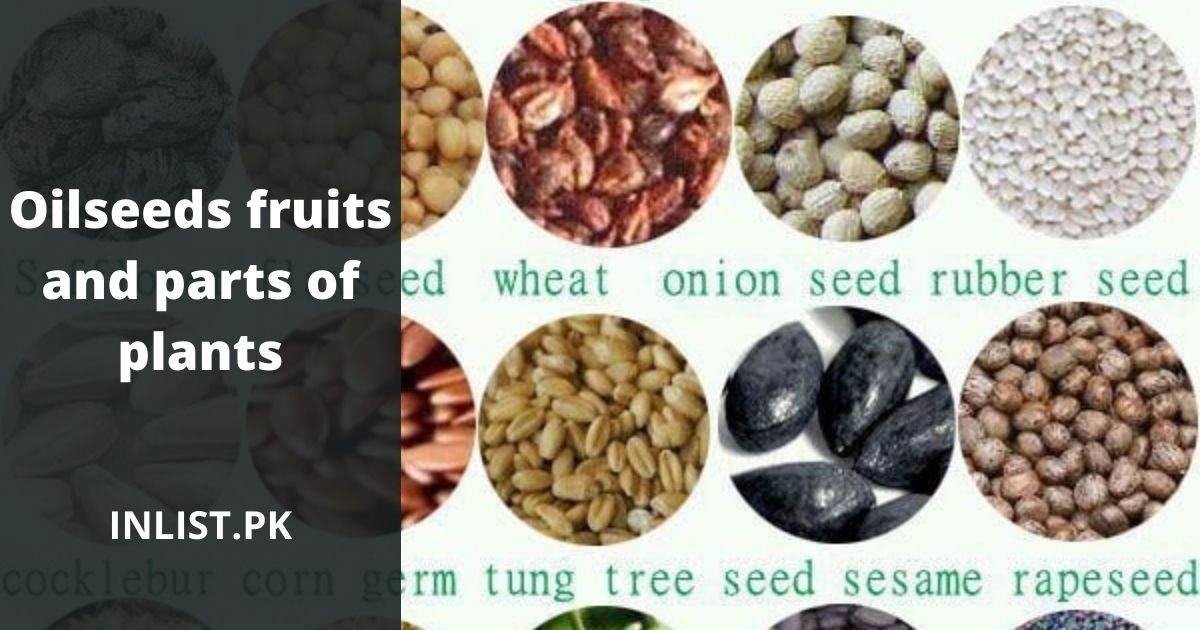

Oilseeds, fruits, and parts of plants

• All Goods of Seed Quality (HSN Code-12)

• Soybean, whether broken or not, of seed quality (HSN Code – 1201)

• Peanuts, not roasted or otherwise cooked, whether shelled or broken of seed quality (HSN Code – 1202)

• Linseed, whether broken or not, of seed quality (HSN Code – 1204)

• Rape or Colza seeds, whether or not broken, of seed quality (HSN code – 1205)

• Sunflower seeds, whether broken or not, of seed quality (HSN code – 1206)

• Other oilseeds and oleaginous fruits (i.e. palm nuts and kernels, cottonseeds, castor oil seeds, sesame seeds, mustard seeds, safflower (Carthamus tinctorius) seeds, melon seeds, poppy seeds, a jam, mango kernel, niger seeds, kokum), or not broken, of seed quality (HSN code – 1207)

• Seeds, fruits, and spores of a type used for sowing (HSN code – 1209)

• Hop Cone, Fresh (HSN Code – 1210)

• Plants and parts of plants (including seeds and fruits), a type used chiefly in perfumery, in pharmacy or for insecticide, fungicide or similar purposes, fresh or chilled (HSN code – 1211)

• Locust beans, seaweed, and other algae, beets, and sugarcane, fresh or chilled (HSN code – 1212)

• Grain straw and husks, unpeeled, chopped, ground, pressed, or in the form of pellets (HSN Code – 1213)

• Swedes, mangold, fodder roots, hay, lucerne (alfalfa), clover, sainfoin, forage kale, lupine, vetch, and similar forage products, whether or not in the form of pellets (HSN code – 1214)

Conclusion goods exempted from sales tax

Goods exempted from sales tax are an amount, calculated as a percentage that is added to the cost of a product or service when consumer purchases it at a retail location. Consumers then pay the United States and local tax rate each time they make a purchase.

Above I have discussed the list of exempted goods under sales tax, read it carefully which will help you to understand about them.